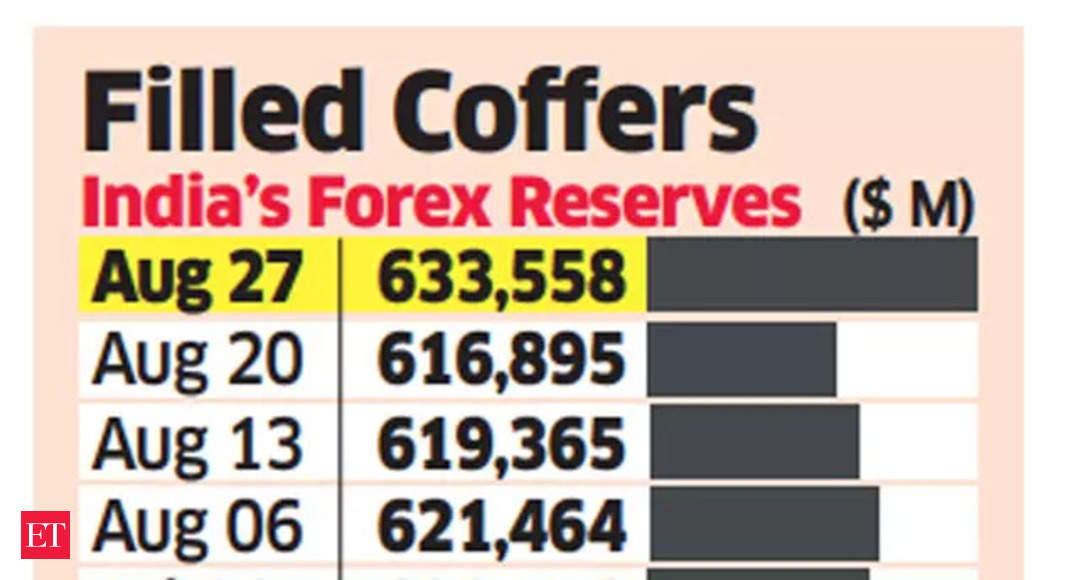

An SDR booster from IMF puts India’s forex kitty at $633 billion

The fresh SDR allocation to the Reserve

(RBI) follows the recent G-20 decision to increase IMF’s lending capacity by $650 billion to fight the economic fallout of Covid-19.

India’s allocation is in proportion to its IMF quota, 2.75%. Reserves rose $16.6 billion from the previous week — among the highest increases in a week since the 2008 financial crisis. At $633 billion, India’s reserves are reckoned to be fourth largest after Japan, China and Switzerland.

“The additional SDR allocation to India comes at a time when RBI’s foreign reserves are already very large and adequate,” said Rahul Bajoria, chief India economist at Barclays Capital. “This should boost RBI’s confidence around reserve adequacy at the margin.” The special drawing right is the IMF’s internal accounting currency unit for member countries.

2-way Intervention

SDR is expressed in dollars for valuation purposes. It’s a weighted average of a basket of currencies, including the dollar, yen, pound, euro and renminbi. Though it’s not traded like other currencies, its value changes along with that of the currencies in the basket.

This rise could be a challenge for the RBI’s reserve management, some experts said. India has been seeing a surge in dollar inflows for over a year now since the pandemic through a variety of sources — portfolio flows, foreign direct investment and commercial borrowings. Analysts expect the central bank to continue with a strategy of two-way intervention — buying and selling as needed.

“We think RBI will mostly engage in two-way FX intervention with an active bias towards keeping INR somewhere in the middle of the EM (emerging markets) pack,” according to a report by

.

Increased allocation of SDRs may lower the cost of holding reserves for the central bank. An SDR allocation is a way of supplementing member countries’ foreign exchange reserves, allowing them to reduce their reliance on more expensive domestic or external debt, according to IMF.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Education News Click Here

For the latest news and updates, follow us on Google News.