Bonds are down but not out

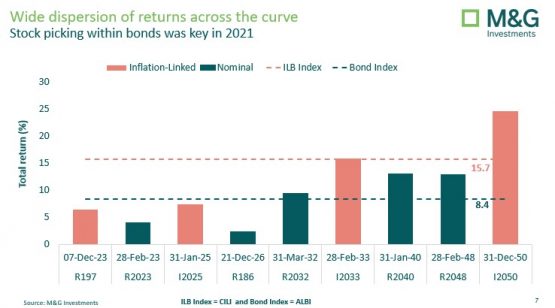

Inflation-linked bonds delivered a return of close to 16% in 2021, against a return of 8.5% for nominal bonds.

These are respectable returns by most measures, considering that cash in 2021 yielded a return of 5.5%, slightly ahead of consumer inflation of around 4.5%.

The chart below shows the different returns from inflation-linked bonds, nominal bonds and cash.

Nominal bonds are also known as fixed interest bonds, reflecting the fact that their coupons (or interest rates) are fixed in a nominal sense, meaning if the coupon rate is 9% a year, that is the interest rate you will get per year.

Inflation-linked bonds, as the name implies, offer a coupon rate that is linked to the inflation rate. This rate is variable, unlike the nominal coupon rate, which is fixed.

Sandile Malinga, portfolio manager at M&G Investments (which is the old Prudential Investment Managers South Africa), says the outlook for bonds remains surprisingly positive, despite two years of strong returns, especially from inflation-linked bonds.

“After a couple of very good years for inflation-linked bonds, we think it’s prudent to start rotating some of those profits into nominal bonds. Investors tend to get a little nervous about these assets after they have had such a strong run, and they tend to think of cash as an alternative.

“While cash is a useful asset to have in stressed periods, in the longer run it has yielded lower returns than nominal and inflation-linked bonds. While there are sometimes long periods of underperformance, we still expect nominal and inflation-linked bonds to deliver cash-beating returns going forward,” adds Malinga.

Source: M&G Investments

Nominal and inflation-linked bonds play an important role in portfolios aiming to deliver real returns of 5% or more.

Returns on cash were as high as 7.5% before the Covid lockdowns, but dropped sharply as central banks the world over cut interest rates. That drew funds into under-valued bonds.

Source: M&G Investments

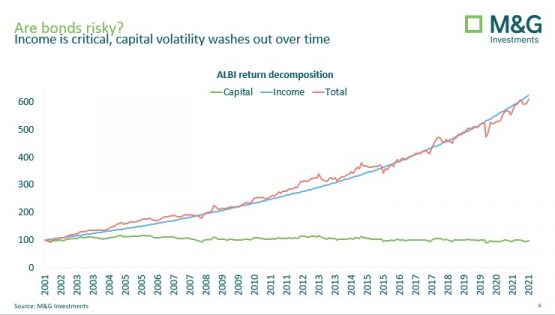

Regarding the claim that bonds are currently risky, analysis by Malinga comes to a different conclusion.

“The graph above shows what happens when we accumulate and reinvest our interest returns. Unlike the first chart which shows how volatile the returns are over time, the above chart shows how that volatility washes out over time if the returns are reinvested. It demonstrates that the income component is the primary driver of returns over the long term.

“From this perspective, we see that our income assets have very low capital volatility in the medium- to long-run. So to our minds, bonds are not nearly as risky as many people believe, and carry significantly less risk than equities, for example.”

Source: M&G Investments

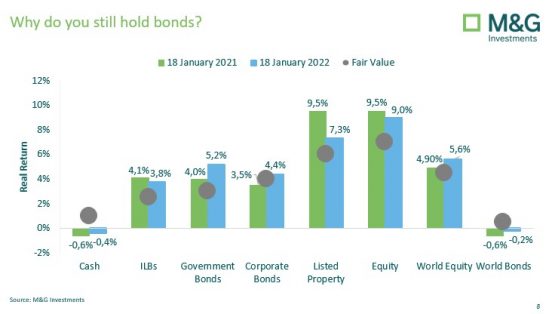

The above chart compares the expected returns on different asset classes, and shows listed property and equities as the assets with the highest return prospects.

“We’re always looking forward and assessing the relative attractiveness of assets,” says Malinga.

“Following the recent rally, nominal bonds are priced to deliver better returns than inflation-linked bonds. If we look at the valuations of these two assets today compared to a year ago, we can see that from today, nominals are priced to deliver over 5% real in the medium term, while inflation-linked bonds, having rallied through 2021, are now priced to deliver just under 4% real. This is still attractive, but the relative valuation favours nominal bonds. As a result, we’ve switched quite meaningfully into the valuations, by taking profit on our inflation-linked bond exposure and reinvesting this into nominal bonds.”

The link between interest rates and equity performance is tenuous, adds Malinga.

This was demonstrated in 2016 and 2017 when the US Federal Reserve raised interest rates with a relatively minor impact on equity prices – in fact US equities rallied 14.7% per annum over that period.

In the same way, there is no certainty that a selloff in US bonds will be mirrored in SA. Valuations in SA bonds appear to be helping buffer local bonds against a rise in global bond yields.

Real bond returns are the best they have been since 2000

Research by M&G Investments shows bonds are currently priced to deliver high real returns.

There is a strong relationship between starting yields and subsequent return. Low starting yields are associated with low future returns, while high starting yields are associated with high future returns.

Malinga says the current yield on the index is about 10%, more than double the consumer inflation rate. “This suggests bonds are offering real returns of 5% to 6% over the medium term. These are some of the highest real returns available on bonds since 2000. This is part of the reason we like having nominal bonds in our portfolios.”

What about inflation concerns?

Investors are increasingly worried about inflation, knowing this erodes the real value of assets. Malinga points out that this argument certainly holds true for foreign bonds which are heavily exposed to inflation pressures. The same cannot be said for SA nominal bonds.

“If we take the current nominal yield on SA 10-year bonds of 9.8%, we can break it up into the real yield component of 3.6%, medium-term expected inflation of 4.5% and a 1.7% inflation-risk premium. This 1.7% is a safety buffer which investors can enjoy, over the next 10 years. It’s quite generous in our opinion, especially given the South African Reserve Bank’s strong inflation-fighting track record.”

Portfolio allocation

M&G Investments has historically had a heavy weighting in inflation-linked bonds, which are strongly linked to property and over time have generated a decent yield.

“We were early into that cycle and performance suffered as a result,” says Malinga.

“Then inflation-linked bonds outperformed, generating a return of 16% in 2021, against a return of 8% to 9% for nominal bonds. We’re always making decisions based on current valuations, so nominal bonds today are looking more attractive. We started taking some profits on inflation-linked bonds and reinvesting into nominals.”

With a current yield of 9.8% on nominal bonds, and a 3.6% yield on inflation-linked bonds, the different of 6.2% is the implied inflation rate – this is the inflation rate bond investors are expecting over the next 10 years. Malinga says this is an over-compensation, as it is unlikely that the Reserve Bank will allow inflation at this level over the next decade.

An oddity of the current market is that US inflation is currently 7.5%, well above the SA inflation rate of 4.5%. This is the first time in decades that US inflation has surpassed that of SA.

Source: M&G Investments

It’s not just about bonds, it’s about which bonds you pick

Picking bonds is a smart move, but just as important is which bonds you pick – active stock-picking in 2021 could have resulted in returns as high as 25% or as low as 4% (barely beating cash).

A similar disparity in returns was evident in the bond market (as the graph shows), so knowing which bonds to pick was another crucial element in generating superior returns, says Malinga.

Brought to you by M&G Investments.

Moneyweb does not endorse any product or service being advertised in sponsored articles on our platform.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Education News Click Here

For the latest news and updates, follow us on Google News.