Column: Proof the IRS targets the poor for tax audits while leaving millionaires alone

The Internal Revenue Service’s preference for handling millionaires and billionaires with kid gloves has been known and documented for years.

But there’s another side of the coin: Where does the IRS really focus its enforcement firepower? On the poorest households in America.

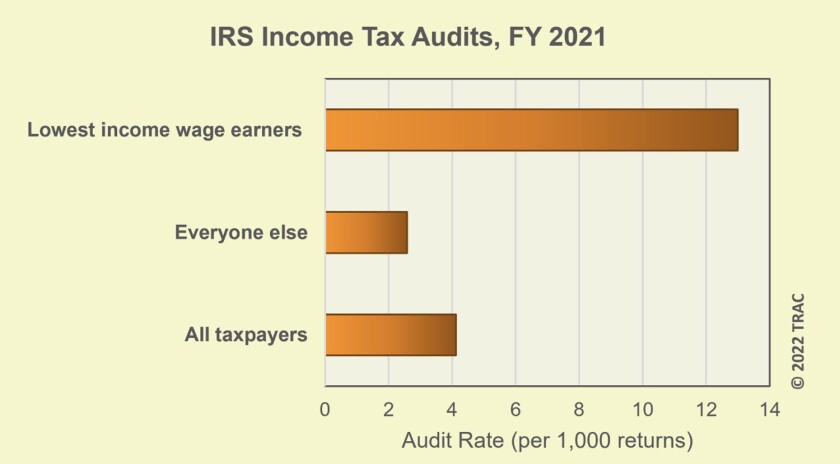

The relevant statistics come to us via TRAC, a nonprofit research data center at Syracuse University. TRAC recently mined IRS statistics and determined that the agency audits households with less than $25,000 in income at a rate five times higher than anyone else.

The IRS correspondence audit process is structured to expend the least amount of resources to conduct the largest number of examinations – resulting in the lowest level of customer service to taxpayers having the greatest need for assistance.

Erin M. Collins, IRS’ national taxpayer advocate

The figures show that the lowest-income wage earners, defined as those eligible for the federal Earned Income Tax Credit, were audited at a rate of 13 per 1,000 returns in 2021. For everyone else, the rate was 2.6 per 1,000 returns.

For married couples with no children, eligibility was capped for the current tax year at adjusted gross income of $22,610. The ceiling rises with family size, but the maximum income this year, for households with three or more children, is $53,057.

It’s impossible to overstate how unjust and wasteful this is. These families tend to be our most financially vulnerable, struggling to pay for basic expenses. They’re the least likely to have professional tax advice, and most likely to have limited education or for English not to be their first language.

When they receive an audit letter from the IRS, their only option to obtain more information is by telephone. But as the agency’s national taxpayer advocate, Erin M. Collins, observed in her most recent report, last year only 11% of callers to the IRS help line got through to a customer service representative.

“Among the lucky one in nine callers who was able to reach a CSR,” Collins wrote, “hold times averaged 23 minutes.” But that was an average; many callers spent much longer on hold.

The financial yield from auditing the lowest-income Americans is minuscule, especially compared to the gains from going after the biggest tax cheats — the wealthy.

The Treasury Department estimates the annual “tax gap,” the difference between what’s owed and what’s collected, at $600 billion a year. Of that sum, Treasury estimates that 28% is owed by the top 1% in income earners, a group with average estimated income of about $1.5 million, and 20.6% of the gap is owed by the top 0.5%, who have average estimated income of about $2.3 million.

For further perspective, consider that the entire tax gap is equal to the income tax owed by the bottom 90% of Americans. Keep that in mind the next time you hear billionaires whine about demands that they pay their fair share of taxes.

“The United States collects less tax revenue as a percentage of [gross domestic product] than at most points in recent history, in part because owed but uncollected taxes are so significant,” Deputy Assistant Treasury Secretary Natasha Sarin observed in the Treasury report.

The lowest-income Americans face the greatest risk of an IRS audit.

(Transactional Records Access Clearinghouse at Syracuse University)

Sarin blamed this performance on “an under-staffed IRS, with outdated technology.” The result is that “audit rates have fallen across the board, but they’ve decreased more in the last decade for high earners than for Earned Income Tax Credit recipients.”

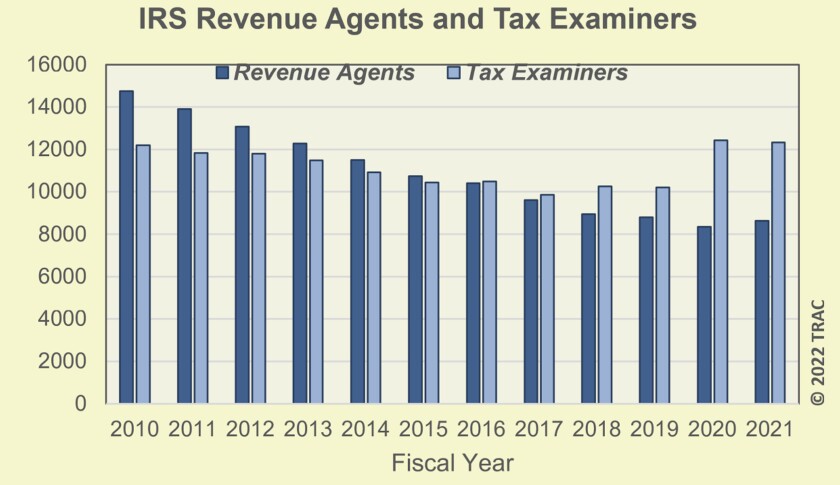

There are several reasons for the discrepancy. One is that it’s harder to recruit and train revenue agents, the most skilled category of enforcement personnel needed to audit the complex returns of the wealthy, than tax examiners, who can handle more routine issues.

In 2010, TRAC found, the IRS employed 14,749 revenue agents and 12,209 examiners. The ratio flipped in 2016 and the imbalance has increased since then, even as the overall size of the enforcement staff has shriveled: By 2021, there were only 8,642 revenue agents and 12,334 examiners. This has happened while the sheer number of tax returns claiming income of $1 million or more has exploded by 50%.

Basic math will tell you that a relative abundance of staff members able to perform only routine examinations will mean more of those, and fewer audits of the complex variety. That’s exactly what has happened.

Throw in the political attacks on the IRS, typically from Republicans, for enforcing the law against the rich, along with the systematic impoverishment of the agency by Congress, and you end up with a toxic enforcement regime, by design.

It should be obvious that pursuing low-income taxpayers won’t do anything to close the tax gap. That’s especially true since the main focus of audits of the lowest income Americans isn’t on whether they’re failing to report income — the vast majority of those taxpayers receive almost all their income in wages, which are reported to the IRS by their employers.

The IRS employs fewer revenue agents, who focus on complex tax returns, than tax examiners, who perform routine audits. The result is more audits of lower-income taxpayers.

(Transactional Records Access Clearinghouse at Syracuse University)

Rather, the focus is on whether the taxpayers are properly reporting their eligible Earned Income Tax Credit, which is based on wages earned and family size. Collins reported that 53% of all audits completed in fiscal 2019 involved taxpayers with less than $50,000 in income, and of those, 82% claimed the EITC.

The EITC is not an especially lavish program, and the gains from enforcement are consequently modest. The maximum credit is $560 for childless couples and $6,935 for the largest families. Since the credit is refundable, meaning that it can exceed the federal income taxes owed, the result for many families is a negative income tax rate.

Collins noted in her report that almost all the audits of low-income households are done by correspondence, rather than summoning the taxpayer to meet face-to-face with an auditor. That may sound like a boon for the taxpayer, but often it’s not.

“The IRS correspondence audit process is structured to expend the least amount of resources to conduct the largest number of examinations — resulting in the lowest level of customer service to taxpayers having the greatest need for assistance,” Collins wrote.

Some 35% of correspondence audits of taxpayers with less than $50,000 in income are closed without any response from the taxpayer, compared to only 20% of taxpayers with higher incomes. As many as 14% of the lower-income taxpayers may not have responded because they didn’t know they’d been audited, Collins reported. The IRS letters may have been returned as undeliverable.

The IRS typically doesn’t follow up — it just imposes a penalty and higher tax. “Lack of sufficient communication was a key factor hindering taxpayers’ resolution of their audits,” Collins’ department concluded from several studies.

If you’re called in for a field audit, by contrast, the IRS doesn’t normally accept no response, and will make an effort to find you.

There’s no underestimating the corrosive effect of America’s financial situation and its politics caused by an increasingly dysfunctional and unfair IRS.

Average taxpayers who will spend hours filling out their tax returns over the next month or so rightfully resent the millionaires and billionaires who are getting away with tax evasion and who they see as laughing all the way to the marina. Doubts about whether the U.S. government is really devoted to helping the little guy can only grow.

Nor have conservatives completed their campaign to shrink the IRS to nothing; as I reported recently, some on the right are calling for giving the IRS less funding, ostensibly as a punishment for its inability to do its job with the skinflint funding it gets now. Sen. Ted Cruz (R-Texas) has based his senatorial campaigns on proposals to abolish the IRS.

Plainly, ideas such as these will only help the rich keep more of the money they owe to the federal government. The rest of us will just get the bill.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Education News Click Here

For the latest news and updates, follow us on Google News.