Foreign investment pledges double in Q2 – BusinessWorld Online

By Abigail Marie P. Yraola, Researcher

APPROVED foreign investment pledges more than doubled in the second quarter from a year ago, as the Philippine economy continued to reopen amid looser mobility curbs.

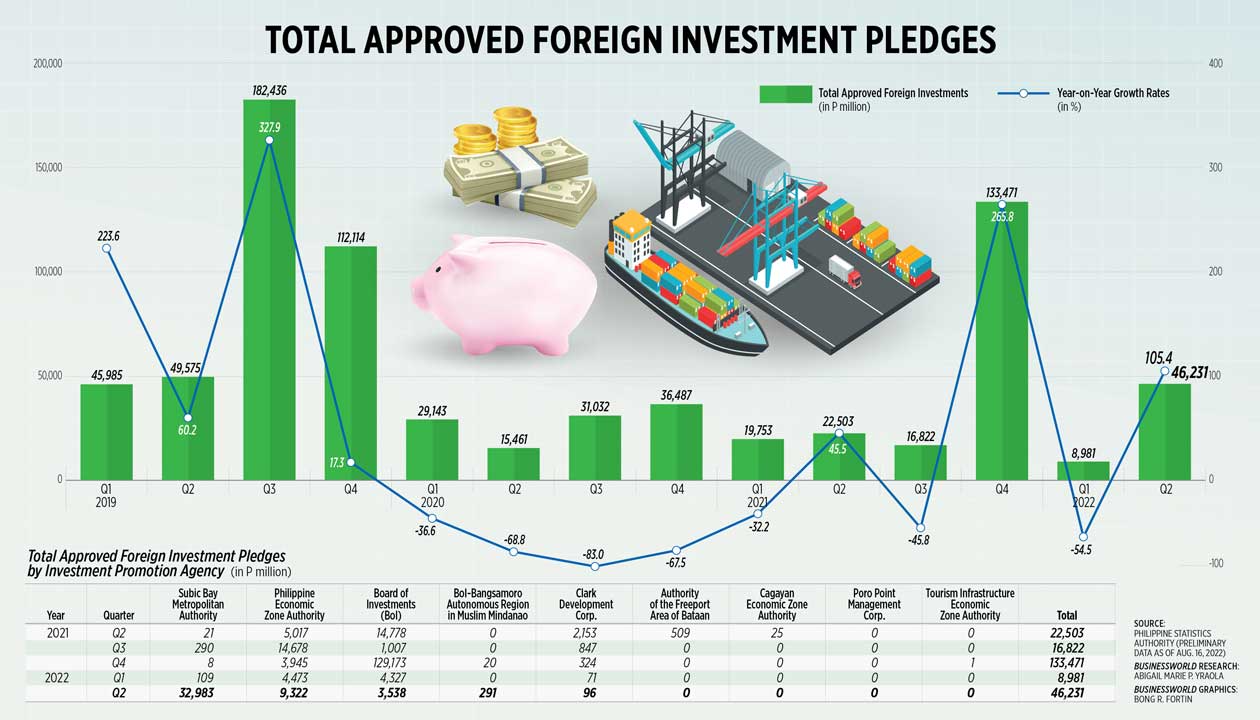

The value of foreign commitments stood at P46.231 billion in the April to June, up by 105% from P22.503 billion a year earlier, preliminary data from the Philippine Statistics Authority (PSA) showed on Tuesday.

This was the highest since the P133.471 billion recorded in the final three months of 2021.

The second quarter’s triple digit increase was the fastest since the 265.8% growth in the fourth quarter of 2021.

The Netherlands was the biggest source of approved investment pledges in the second quarter at P19.037 billion, followed by Singapore and Japan with commitments worth P15.887 billion and P6.508 billion, respec-tively.

Security Bank Corp. Chief Economist Robert Dan J. Roces said the approved investment pledges bode well for economic recovery.

“Recall that one of the drivers for the 7.4% second-quarter gross domestic product growth was expanded capital formation, with a sizeable contribution from (foreign direct investment),” he said in an e-mail interview.

Preliminary data from the PSA showed the economy expanded by 7.4% in the second quarter, slower than the 12.1% in the same period a year earlier and 8.2% in the first quarter.

“Factors include improved mobility, which allowed for more investments, and better confidence in the Philippine economy,” Mr. Roces said.

Most parts of the country have been under the most lenient Alert Level 1 since March. Economic activity got a lift from easing travel restrictions and election spending.

Asian Institute of Management economist John Paolo R. Rivera also attributed the higher investment pledges to the “renewed optimism for the economy given a new administration and the improvement of the investment climate due to lagged effects of fiscal monetary policy implemented before.”

Ferdinand R. Marcos. Jr. won by a landslide in the May 9 presidential elections, and assumed office on June 30.

REAL ESTATE

The PSA said 41.7% or P19.295 billion of the approved foreign investments would go to real estate activities. Investments in the transportation and storage sector amount to P14.524 billion, followed by manufacturing at P6.154 billion.

In the second quarter, investment commitments were approved by five investment promotion agencies — Board of Investments (BoI), BoI-Bangsamoro Autonomous Region in Muslim Mindanao, Clark Development Corp., Philippine Economic Zone Authority (PEZA), and Subic Bay Metropolitan Authority.

The SBMA approved the bulk or 71.3% of the total, which reached P32.983 billion. PEZA approved commitments worth P9.322 billion, while BoI greenlit P3.538 billion in pledges.

The Poro Point Management Corp. and Tourism Infrastructure Economic Zone Authority did not approve investments for the second quarter of 2022 and 2021.

Nearly three-fourths or P33.935 billion of foreign investment pledges will finance projects in Central Luzon. Central Visayas cornered P3.938 billion or 8.5% of the total, while Calabarzon — the region that comprise Cavite, Laguna, Batangas, Rizal and Quezon — got P3.701 billion or an 8% share.

Should these foreign commitments materialize, these projects will generate 12,626 jobs, 25.8% lower than the projected additional employment of 17,013 in the same quarter in 2021.

Meanwhile, investment pledges by Filipinos hit P53.38 billion in the second quarter.

This brought the total commitments to P99.611 billion, with Filipinos accounting for 53.6% of the total.

If investor sentiment further improves, Mr. Roces said foreign commitments would go up.

“Downside risks remain in regard to global inflation, but lower global commodity prices should provide some relief in the final quarter, and investments should pour in,” he added.

PSA data on foreign investment commitments differ from actual FDIs tracked by the Bangko Sentral ng Pilipinas (BSP) for the balance of payments. The central bank’s monitoring goes beyond the projects and includes other items such as reinvested earnings and lending to Philippine units via their debt instruments.

PEZA INVESTMENTS

Meanwhile, PEZA is targeting to attract more investments from Australia and New Zealand.

“Among the target sectors we’re looking at, the best bets would come from manufacturing and information technology, data centers, telecommunications and agriculture,” PEZA Officer-in-Charge and Tereso O. Panga told reporters on the sidelines of the Pacific Business Mission to the Philippines investment briefing on Tuesday. “Also on mineral processing because of the status of the Philippines being the fifth most mineralized country in the world,”

Delegates from Australia and New Zealand will attend briefings and meet potential developers for the location of their businesses in the Philippines, he said.

“We expect investments to be realized out of this investment mission. They have been working on this since the pandemic and their coming here is surely a sign of their strong interest in investing in the Philippines,” Mr. Panga said.

He said there were 138 Australian enterprises registered with PEZA as of June. The enterprises are involved in shipbuilding, business process outsourcing, call centers, software development, engineering, architectural and other design services.

Some of the top Australian enterprises registered with PEZA include Austal Philippines, ANZ Global Services and Operations (Manila), Inc., RD Environmental Solutions, Inc., Telstra International Philippines, Inc., and QBE Group Shared Ser-vices Ltd. – Philippines Branch.

“These companies contribute P14.632 billion of investments, generate $351.944 million of exports, and created 43,033 direct jobs,” Mr. Panga said.

There were three New Zealand companies registered with PEZA as of June this year, he added. The companies are engaged in rubber and plastic products, business process outsourcing, engineering, architectural, and other design services.

Mr. Panga said PEZA is looking at other countries for potential investment opportunities.

“Other than Australia and Japan, we are reaching out to nontraditional sources of investments and trade. The Regional Comprehensive Economic Partnership (RCEP) members would be a good start like China, Australia and New Zealand. The Middle East also has a good potential as well. Also the European Union because they are looking at the Philippines as their potential base in the region for their logistics hub,” he said.

“The RCEP and other free trade agreements “will diversify the country’s exports in terms of products and services and country destinations and enhance the country’s attractiveness to foreign investments,” he added. — with Revin Mikhael D. Ochave

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Education News Click Here

For the latest news and updates, follow us on Google News.