Gone to pot: It could be years before Medicare covers medical marijuana

Many older adults are using medical marijuana to treat a variety of conditions, but experts say that conflicting laws, unclear safety standards and complicated rulemaking processes mean it could be years before Medicare may cover the drug.

One in five Medicare recipients uses medical marijuana, according to an April 2022 poll by the Medicare Plans Patient Resource Center. Nearly a quarter respondents said they used medical marijuana in the past.

Two-thirds of Medicare recipients think Medicare should cover it, the poll found.

A clerk reaches for a container of marijuana buds for a customer Oct. 2, 2018, at Utopia Gardens, a medical marijuana dispensary in Detroit.

Here’s where the situation stands:

Why cover medical marijuana for older adults?

In one analysis of data from a large cannabis dispensary in New York, 60% of patients were 50 or older, according to an April 2022 paper in the journal Cannabis and Cannabinoid Research. The patients used cannabis for severe or chronic pain, cancer, Parkinson’s disease and neuropathy, among other things.

People are also reading…

It isn’t cheap: Patients might pay as much as $5 per dose for edible products or $5 to $20 per gram for plant buds, according to New York Cancer & Blood Specialists, which provides care to patients with cancer and blood disorders. That’s about $142 to $567 per ounce. Even in states where medical marijuana can be legally prescribed, patients might not be able to afford the prescription.

“This medicine is so expensive,” says Debbie Churgai, executive director of the nonprofit Americans for Safe Access, a nonprofit dedicated to ensuring safe and legal access to cannabis for therapeutic use and research. “There are some states now where insurance will cover the cost of the doctor visit or the cost of the marijuana card, but no insurance will cover the cost of the actual products.”

Heather Randazzo, an employee at Compassionate Care Foundation’s medical marijuana dispensary, trims leaves off marijuana plants March 22, 2019, in the company’s grow house in Egg Harbor Township, N.J.

What are the federal roadblocks?

The first issue is that the government classifies marijuana as a Schedule I drug, with “no currently accepted medical use and a high potential for abuse” in the U.S., according to the Drug Enforcement Administration.

“There is no way the federal government is going to reimburse people through a federal program for a substance they deem as illegal,” says Paul Armentano, deputy director of the National Association for the Reform of Marijuana Laws.

The second issue is that Medicare requires that the Food and Drug Administration approve a drug as safe and effective. While the FDA approved one cannabis-derived drug product and three synthetic cannabis-related drug products for prescription use, it hasn’t approved marketing cannabis for medical treatment.

What about in states where it’s legal?

Sure, marijuana is illegal at the federal level, but medical marijuana is now legal in 37 states and Washington D.C. Could private insurers — companies that offer Medicare Advantage, for instance — decide to cover it?

Not likely, says Kyle Jaeger, a cannabis policy reporter and senior editor at cannabis news site Marijuana Moment. Like banking institutions that hesitated to offer services to marijuana businesses, major health insurers likely will decline to cover cannabis as long as it remains a Schedule I drug under federal law.

Also, private insurers rely on the FDA to guide them on which drugs to cover. The FDA said in January that current regulatory pathways are insufficient to allow the agency to classify CBD as a dietary supplement.

Marijuana plants Feb. 26, 2020, at a growing facility in Oklahoma City.

How high is the bar for cannabis coverage?

Among other things, the marketplace needs more data on the medicinal use of cannabis. “(Insurers) need data to show that the outcomes from cannabis care are equivalent to, if not better than, existing options that they do cover,” says Dr. Benjamin Caplan, founder and chief medical officer of CED Clinic, which provides services to people seeking cannabis treatment.

This is partly complicated by the free-market dispensary system in which patients are free to buy any product. “The system has to be tweaked,” Caplan says. “Patients can’t just have carte blanche to buy whatever they want and the insurance companies are on the hook to cover that.”

Considering the breadth of legal and regulatory obstacles, plus an overhaul of the dispensary system, Jaeger says, “I’d say we are many years from having that conversation and rulemaking for something like Medicare.”

25 most commonly used recreational drugs in America

America’s vices: Alcohol, tobacco and more

From alcohol to cigarettes, most adults have tried some form of recreational drug. Fewer people have experimented with prescription medication for recreational reasons, but certain areas of the country are experiencing a serious problem with opoid addiction. Other drugs like cocaine and LSD, are used sporadically among adults in the U.S.

Using data from the Substance Abuse and Mental Health Data Archive, the experts at HealthGrove, a health data site, ranked the 25 most commonly used recreational drugs. The substances are ordered by the increasing percentage of people age 12 and over who used the drug recreationally in 2015. In the case of a tie, the drug with a higher classification by the Drug Enforcement Administration (DEA) is ranked higher.

To collect this data, SAMHDA conducts the annual National Survey on Drug Use and Health, in which they record use of illicit drugs, alcohol and tobacco in the U.S. population aged 12 or older. It is important to note that this data only includes recreational use of drugs, not proper medical use.

Drugs that are legal, alcohol and tobacco, have the highest recreational use. According to the survey, nearly one in five people over the age of 12 also used marijuana in 2015. As the drug becomes legal in more states, recreational use is likely to increase. Other Schedule I drugs (drugs determined to have no medical benefit by the DEA) including heroin and DMT had a recreational prevalence rate of less than 1 percent in 2015.

Note: Not all images in slideshow depict the exact drugs.

#25. Ketamine

#24. Oxymorphone

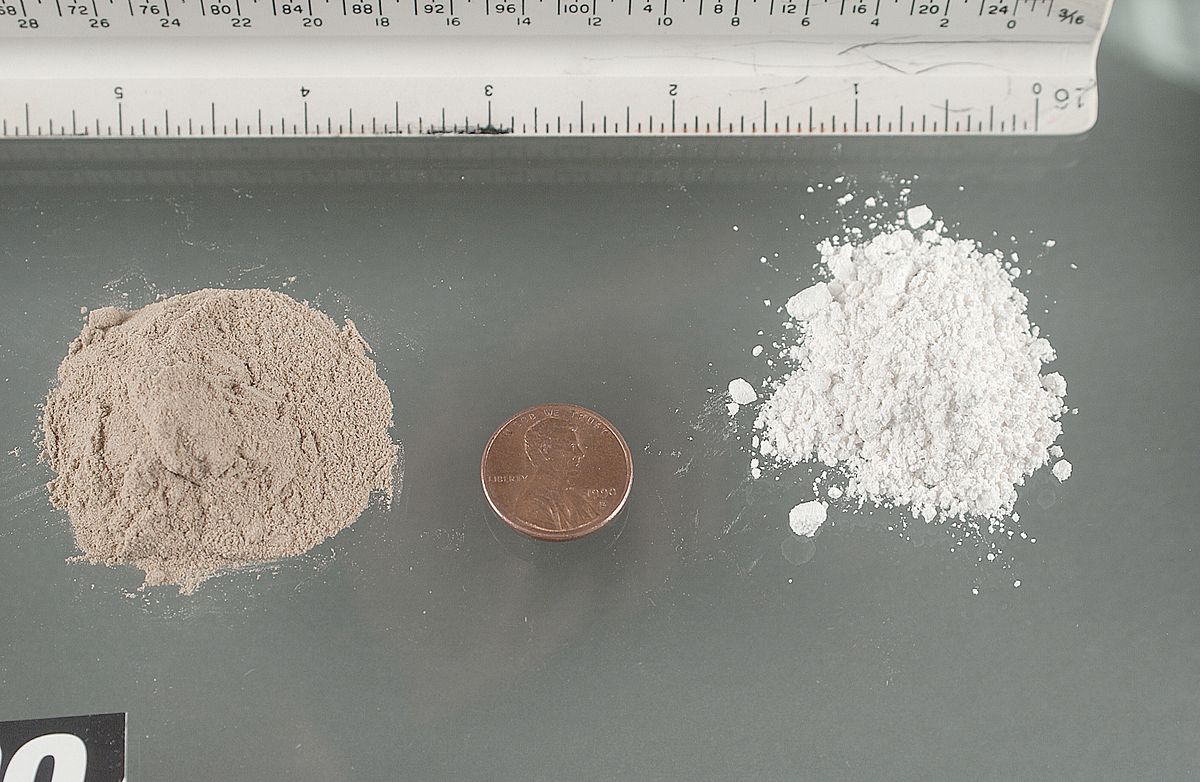

#23. DMT

Recreational use prevalence (2015): 0.2 percent

Drug category: Hallucinogen

DEA Schedule: I

Common forms: Powder, crystal

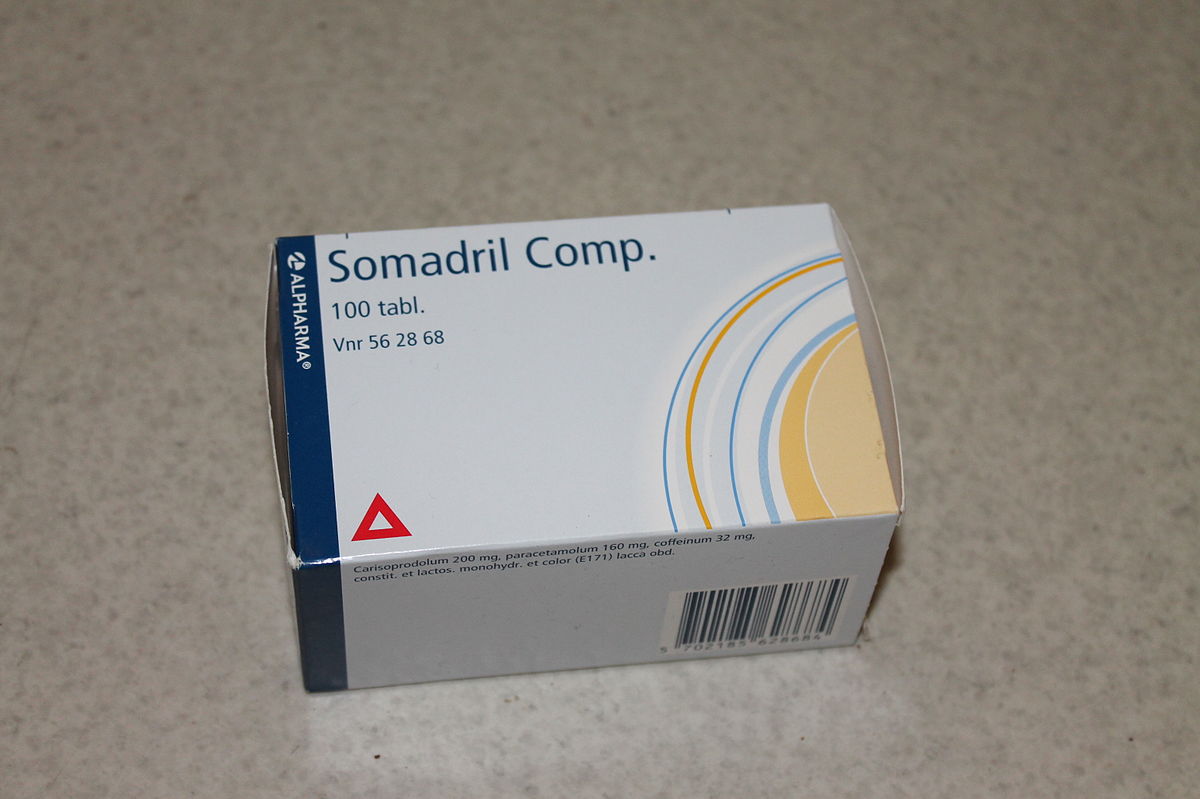

#22. Carisoprodol (Soma)

#21. Methadone

#20. Lorazepam (Ativan)

#19. Morphine

#18. Buprenorphine

Recreational use prevalence (2015): 0.38 percent

Drug category: Opioid

DEA Schedule: III

Common forms: Pill

#17. Heroin

#16. Zolpidem (Ambien)

Recreational use prevalence (2015): 0.45 percent

Drug category: Sedative

DEA Schedule: IV

Common forms: Pill, capsule, liquid

#15. Diazepam (Valium)

Recreational use prevalence (2015): 0.54 percent

Drug category: Tranquilzer

DEA Schedule: IV

Common forms: Pill, capsule, liquid

#14. Clonazepam (Klonopin)

Recreational use prevalence (2015): 0.6 percent

Drug category: Tranquilzer

DEA Schedule: IV

Common forms: Pill

#13. Methylphenidate (Ritalin)

#12. Methamphetamine

#11. Tramadol

#10. LSD

#9. MDMA (Ecstasy/Molly)

Recreational use prevalence (2015): 1.5 percent

Drug category: Hallucinogen

DEA Schedule: I

Common forms: Tablet, capsule, liquid

#8. Alprazolam (Xanax)

#7. Oxycodone (OxyContin)

Recreational use prevalence (2015): 2.05 percent

Drug category: Opioid

DEA Schedule: II

Common forms: Capsule, liquid, tablet

#6. Cocaine

#5. Amphetamine (Adderall)

#4. Hydrocodone (Vicodin)

#3. Marijuana

#2. Tobacco

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Health News Click Here

For the latest news and updates, follow us on Google News.