How to use the PayPal Pay in 4 microloan program

There’s no need to wait to make essential tech purchases with PayPal’s four payment microloan program.

Image: Poike, Getty Images/iStockphoto

Technology has a tendency to break at the most inopportune moments, including when you don’t have enough money to cover an essential purchase that can get you back to work. If you need to make a purchase between $30 and $600, PayPal’s Pay in 4 program might help.

Pay in 4 is PayPal’s entry into the “buy now, pay later” offering available from other companies like Afterpay, Sezzle and Klarna but with these added features: It exists as part of a trusted payment platform, it’s available for all users with a credit or debit card on file, and it doesn’t have any fees or interest if the payment schedule agreement is upheld.

SEE: IT expense reimbursement policy (TechRepublic Premium)

Pay in 4 microloans don’t affect credit, either: A soft check is performed, but it won’t show up on your credit report or cause a loss in points. Once you’re approved, PayPal will automatically divide the loan up into four installments, the first of which is due when you make the purchase, spaced out every two weeks for a total period of six weeks. Late fees can apply and vary by state (Pay in 4 is only available in the U.S.).

How to make a PayPal Pay in 4 purchase

Since PayPal is essentially covering your entire bill with the merchant up front, Pay in 4 can be used at all retailers that support PayPal. Signing up isn’t difficult if you’ve used PayPal before, either. For this example, I’m checking out at Best Buy, but the process should be nearly identical for other retailers.

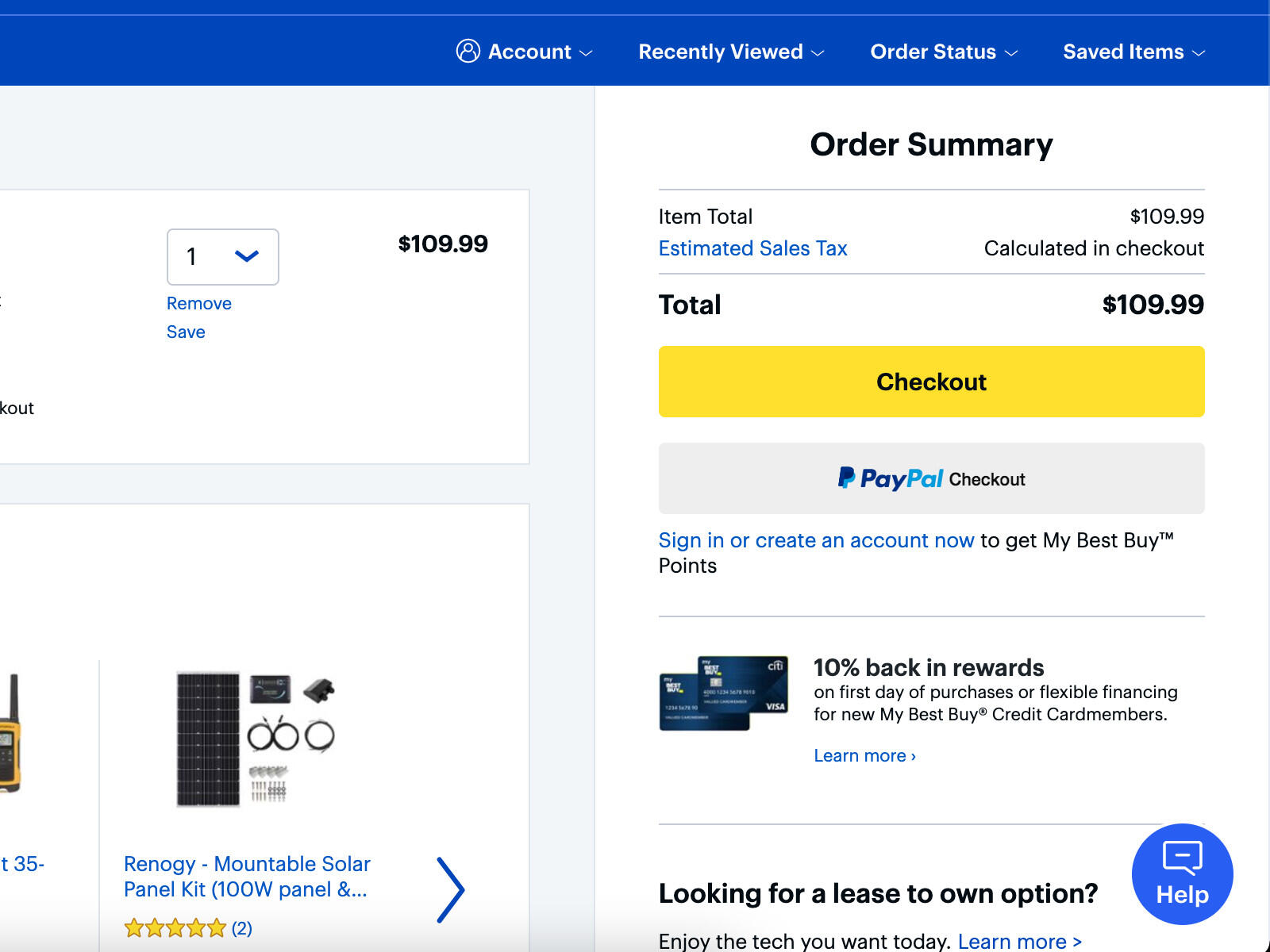

Look for the PayPal checkout button or its equivalent when checking out (Figure A) and select it. This should take you to PayPal to complete the transaction.

Figure A

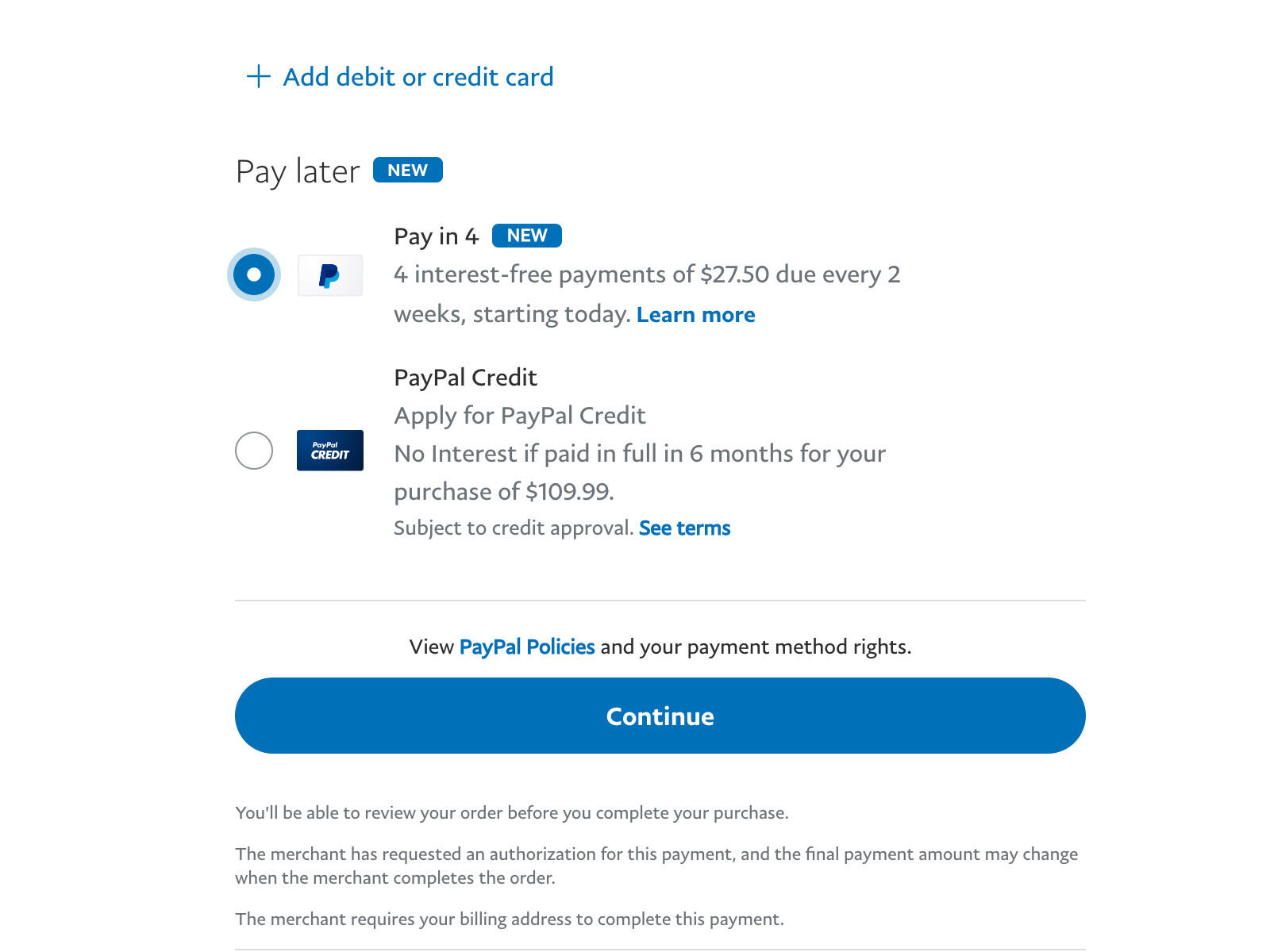

Once you’re logged in to PayPal, you should see a list of funding options (debit cards, bank accounts, etc.), and below that are the options for Pay in 4 and PayPal Credit (Figure B). You should see the amount the payments will be before you even click on the Pay in 4 option.

Figure B

Choosing Pay in 4 while logged in to PayPal

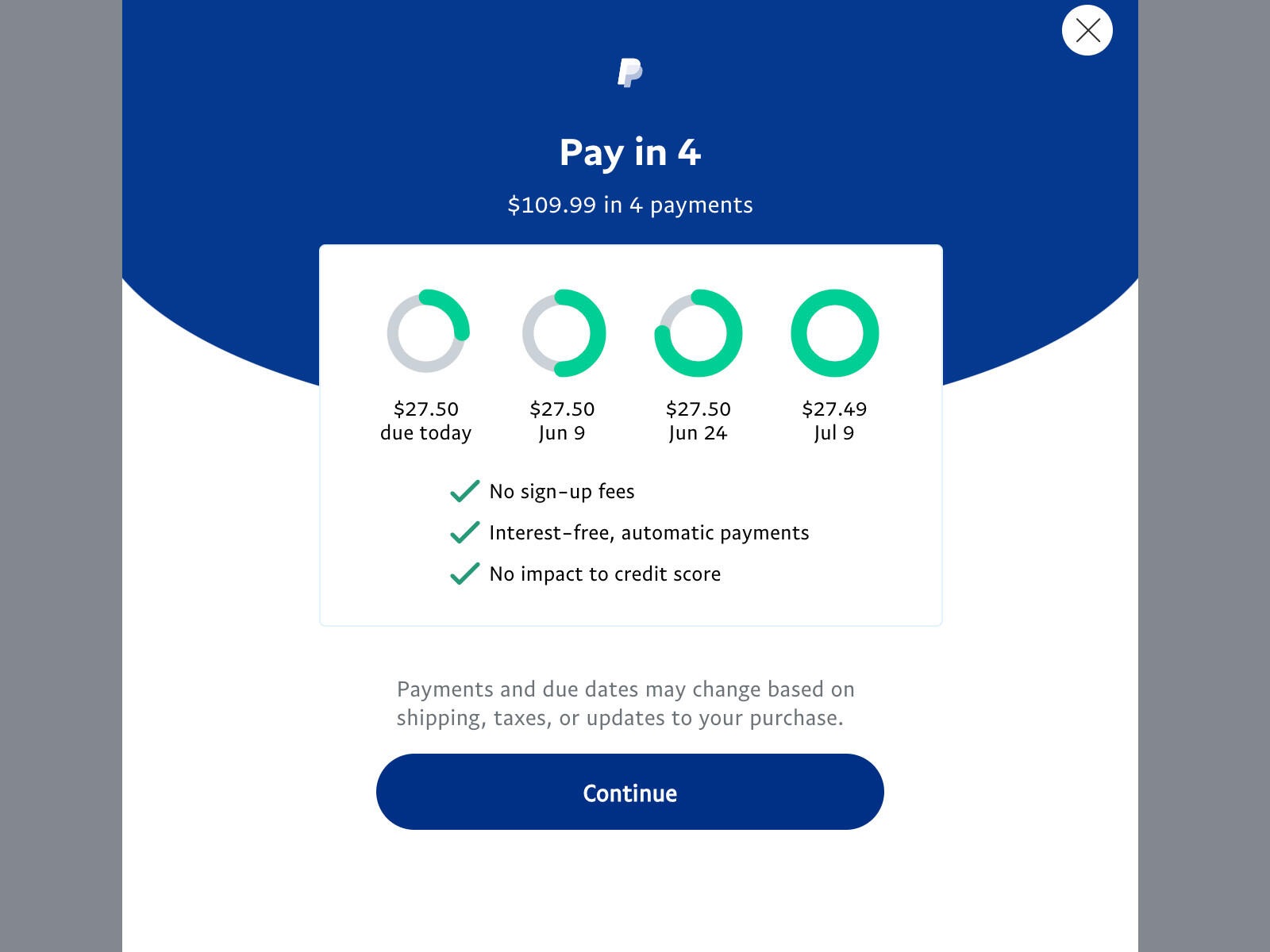

After you choose Pay in 4 and click Continue, you’ll see the screen shown in Figure C, where PayPal outlines the payment amounts and due dates for your Pay in 4 plan. Clicking Continue still won’t complete the process–you have several opportunities to cancel your purchase or choose a different funding method.

Figure C

A look at a PayPal Pay in 4 agreement

SEE: Home office deduction guide and checklist (TechRepublic Premium)

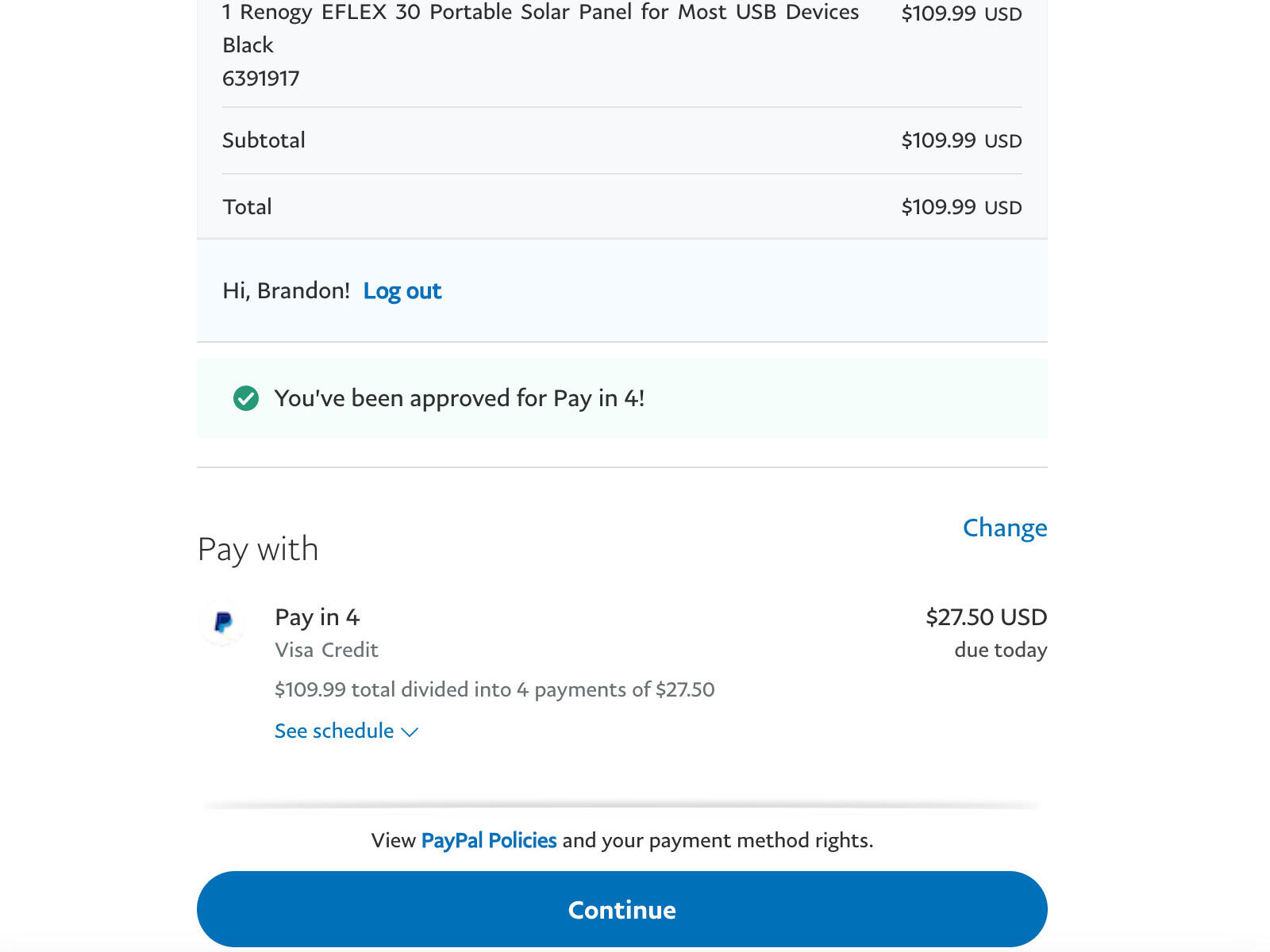

After clicking continue in Figure C, you’ll need to choose a funding option for your Pay in 4 plan, which will be one of the credit or debit cards linked to your PayPal account. Once you choose a funding option, the system will run its soft credit check, and hopefully you’ll be met with Figure D, where you can see my Pay in 4 plan was approved. You will also be able to see the last four numbers of the card you used to schedule automatic payments from, and the amount due today.

Figure D

Finalizing a PayPal Pay in 4 plan

Once you click on Continue, PayPal will return to the vendor’s website, where you can double-check shipping information and finalize the purchase. PayPal will take it from there and pay the vendor whatever you owe, and then automatically withdraw money from the debit or credit card you chose on the dates you agreed to.

Also see

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.