JPMorgan plots ‘astonishing’ $12bn tech spend to beat fintechs

JPMorgan Chase, the largest lender on Wall Street, said it plans to dramatically increase spending on technology and talent to fortify its competitive position, stirring investor worries about US bank earnings in 2022.

As it reported record profits last year, JPMorgan stunned analysts with a forecast that expenses would increase by 8 per cent this year to around $77bn, meaning it would probably miss a key profitability target in 2022, and possibly in 2023.

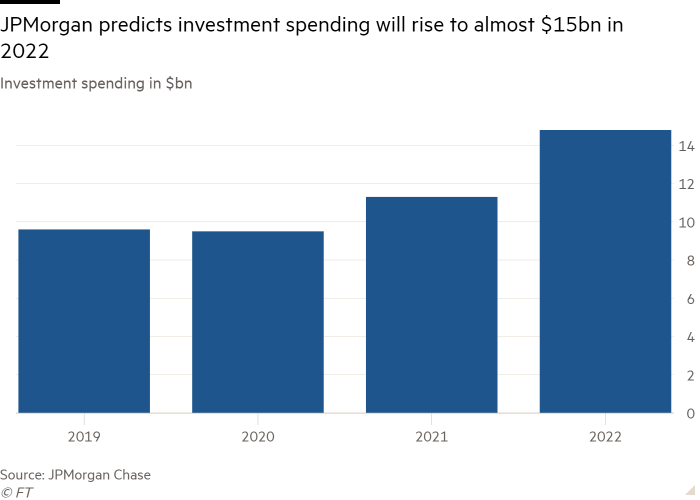

Part of the elevated expenses are from higher pay, with an extra $2.5bn earmarked for compensation and travel expenses. But JPMorgan also said it planned to increase new investments this year by $3.5bn, or 30 per cent, to almost $15bn. Technology spending in 2022 will hit $12bn in 2022, it said.

“The global technology spend at around $12bn, that’s an astonishing number,” said James Shanahan, an analyst with Edward Jones. “That probably blows away the cumulative dollar value of investment of all the fintechs in the world that are trying to disrupt them.”

JPMorgan shares, which have nearly doubled from the depths of the pandemic, fell more than 6 per cent on Friday. This also dented the stock prices of other major banks set to report earnings next week, with Morgan Stanley down 3.6 per cent, Goldman Sachs 2.5 per cent and Bank of America 1.7 per cent.

Jamie Dimon, 65, who has carved out a reputation for cost control as JPMorgan’s chief executive since 2005, told analysts the bank would need to “spend a few bucks” to beat competitors.

However, the spending plans prompted Mike Mayo, a banks analyst at Wells Fargo who has recommended JPMorgan to clients for the past seven years, to downgrade the bank’s stock, absent any performance metrics attached to the increased spending.

“Even Jamie Dimon, one of the best bankers of his generation, doesn’t get a free pass to increase investment spending by half over three years without giving more granularity about expected benefits,” Mayo said.

JPMorgan is ramping up spending just as a surge in dealmaking activity that produced record investment banking revenue is starting to lose steam. Investors had hoped that rising interest rates — and higher rates on loans — would help compensate, but instead much of this benefit will now go to fund new investments.

The big spending reflects the pressure on banks to compete with financial technology companies like payments processor Stripe, instalment lender Affirm and challenger bank Chime.

Jeremy Barnum, JPMorgan’s chief financial officer, said the bank was in a “moment of acceleration” of investment spending. “Part of the reason for that is the amount of competition out there in the market,” Barnum said in a call with reporters, “especially from novel entrants”.

JPMorgan is earmarking new funds for data centres and cloud computing as sell as expansion into new markets like the UK and marketing costs.

Executives say investments in technology today will ultimately result in lower operating costs. But it could take years to realise those savings and the lack of granular detail is a source of frustration for investors.

“You, as a shareholder, as an outsider, are never going to be able to tell the difference between investment spending and just plain old spending until three years later. So you just have to take it on faith,” said Chris Kotowski, banks analyst at Oppenheimer & Co.

After fourth-quarter earnings at Citigroup, which has already been spending heavily to bolster its technology under regulatory pressure following mishaps at the bank, chief financial officer Mark Mason called technology a “very important growth line” in the bank’s expense base, without giving a specific forecast.

The bank’s stock closed down 1.25 per cent on Friday.

Meanwhile, Wells Fargo shares rose 2 per cent after the bank reported revenues climbed 12 per cent in the fourth quarter as it sought to recover from a false-accounts scandal. The bank said its expenses would probably be lower than in 2021 even as it plans an extra $1.2bn in investments in technology and compensation.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Education News Click Here

For the latest news and updates, follow us on Google News.