Payment Gateway Market Size to Surpass USD 161 Billion by 2032 at Sustained CAGR of 20.5% – Market.us Study

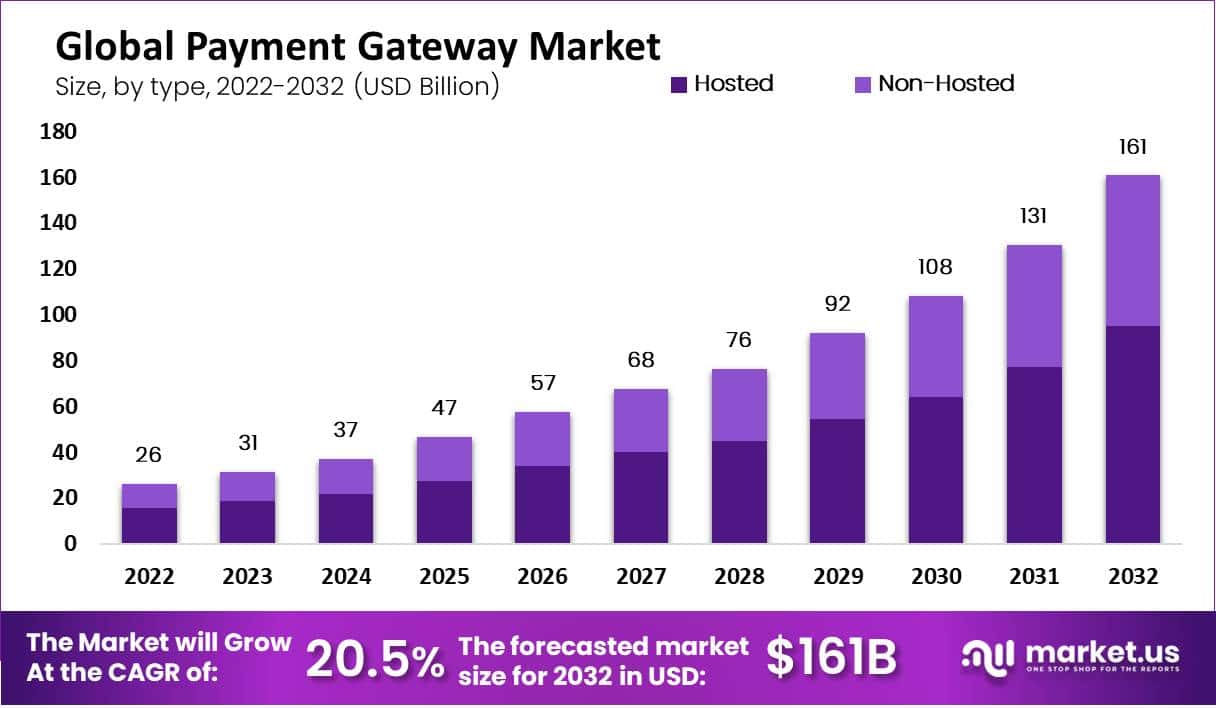

New York, May 01, 2023 (GLOBE NEWSWIRE) — The global payment gateway market size is expected to be worth around USD 161 Billion by 2032 from USD 26.1 Billion in 2022, growing at a CAGR of 20.5% during the forecast period from 2022 to 2032. Increasing e-commerce sales also expanding the use of the internet globally are significant factors that are anticipated to contribute to the growth of the payment gateway market.

The industry is also predicted to grow in the upcoming years as a result of the shift in consumer as well as merchant preferences towards digital channels that enable online money transfers. The market for payment gateways is one area of the financial technology business that is expanding quickly. By allowing the flow of payment information between the merchant and the acquiring bank or payment processor, a payment gateway is a piece of technology that enables merchants to safely conduct online transactions. Fintech companies are creating cutting-edge payment solutions to meet the growing need for convenient also secure online payment methods. New competitors are now entering the payment gateway market as a result of this. Payment gateways built on the blockchain, offer greater security as well as transparency in transactions.

Get additional highlights on major revenue-generating segments, Request a Payment Gateway Market sample report at https://market.us/report/payment-gateways-market/request-sample/

Key Takeaway:

- By type, the hosted segment dominates the market with 59% of the market share. Owing to the simple payment process and decreased merchant liability

- By enterprise size, the larger enterprise segment dominates the market with a 55% market share. Owing to the larger website traffic larger businesses them checkout solutions for their client.

- By end-user, the retail and e-commerce segment dominates the payment gateway market with a 28% market share. For online shops and e-commerce companies to receive customer payments, payment gateways are crucial.

- In 2022, North America dominated the market with the highest revenue share of 38%.

- APAC is expected to grow at a greater pace owing to the growing adoption of mobile payment as well e-commerce is driving the growth of the market in this region.

Factors affecting the growth of the payment gateway industry

There are several factors that can have an impact on the growth of the payment gateway industry. Some of these factors include:

- Rising e-commerce: Companies are opening online shops as a result of its rising popularity. To process transactions and also enable online payments, these firms require a trusted and secure payment gateway.

- Digital Payment Adoption: More and more customers are using digital payments to pay for goods and services. The growth of mobile wallets and contactless payments, also the simplicity and security of digital payments, are all driving this trend.

- Security and Fraud Prevention: Payment gateways are made to be safe and guard against fraudulent transactions. This has boosted consumer trust in online transactions as well as prompted more companies to employ payment gateways.

- Globalization of Businesses: As companies expand internationally, they want payment gateways that can process cross-border and various currency transactions. Payment gateways have expanded their services to accommodate international transactions in response to these needs.

- Technical developments: By boosting productivity and security, emerging technologies like blockchain and artificial intelligence have the potential to completely change the payment gateway market.

- Government Regulations: To encourage the usage of digital payments and improve the security of online transactions, governments have put restrictions into place. By making it simpler for firms to comply with standards and laws, these regulations have promoted the expansion of the payment gateway industry.

To understand how our report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/payment-gateways-market/#inquiry

Top Trends in The Payment Gateway Industry

The payment gateway industry has experienced substantial expansion and change in recent years. The demand for secure yet effective payment processing solutions has exploded with the growth of e-commerce and the expanding use of digital payments. Such as, there are many suppliers vying for market share in the increasingly crowded and competitive payment gateway industry.

The increased emphasis on security and fraud protection has been one of the key trends in the payment gateway industry. Payment gateway providers have had to make significant investments in cutting-edge security measures as cyber-attacks and data breaches become more common as well as sophisticated to safeguard sensitive client information and stop fraudulent transactions. The increasing significance of mobile payments has been a further trend in the payment gateway industry. Payment gateway providers have had to modify their services to fit the needs of mobile customers as consumers use their cell phones to make transactions in greater numbers. Owing to mobile-specific payment methods like in-app purchases, mobile wallets have been created.

Market Growth

A significant factor in the expansion of the payment gateway industry has been the development of e-commerce, internet banking, and mobile payments. The demand for secure, dependable, and convenient payment solutions has increased as consumers increasingly use digital channels for their purchases as well as payments. By providing safe online payment processing between retailers and customers, payment gateways enable these transactions.

The market for payment gateways is expanding as a result of the rising use of cloud-based payment gateways, artificial intelligence (AI), machine learning (ML), also other factors. These technologies are assisting in streamlining payment processing, lowering fraud as well enhancing customer experience in general. The market for payment gateways is also expanding due to the rising use of contactless payments and digital wallets. Owing to the rise in demand for contactless payment methods brought on by the COVID-19 epidemic, the market for payment gateways has expanded even faster.

Regional Analysis

North America is estimated to be the most profitable market in the global payment gateway market, with the largest market share of 38%. The North American payment gateway market is one of the largest, with The United States and Canada leading the market. The region’s highly developed e-commerce industry is fueling growth within this sector as well as rising mobile payment adoption also digital wallet adoption rates. All these factors have combined to propel market development within this region. The Asia-Pacific region is one of the fastest-growing regions for the payment gateway market with countries like Japan, India, China, and South Korea driving the growth sector. The growing adoption of mobile payment as well as e-commerce is driving the growth of the market in this region.

Have Queries? Speak to an expert or Click Here To Download/Request a Sample

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | USD 26.1 billion |

| Market Size (2032) | USD 161 billion |

| CAGR (from 2023 to 2032) | 20.5% from 2023 to 2032 |

| North America Revenue Share | 38.0% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

The need for payment gateway solutions has been fuelled by the expansion of the e-commerce sector. Businesses need dependable also secure payment gateway solutions to process their transactions as more customers shop online. There is a rising need for payment gateway solutions that are mobile device-optimized due to the widespread use of smartphones and other mobile devices. Payment gateways that handle mobile payments have become a critical component of many firms’ payment processing operations. Security is a key element influencing the payment gateway business. While making online transactions, consumers are concerned about the security of their financial and personal information, therefore businesses must make sure they offer safe payment processing solutions. As e-commerce has become more prevalent, there is a greater need for payment gateways that can handle transactions in many currencies as well as tongues. The importance of payment gateways with multi-currency support and localization capabilities is growing in the context of global e-commerce.

Market Restraints

Some types of credit cards and foreign transactions may not be supported by payment gateways, which could limit their application to some customers and companies. Integration of payment gateways into existing systems can be a difficult process that calls for technical expertise and resources. Payment gateway providers have to follow several rules and regulations, such as PCI-DSS, which can cost time and money. In the very competitive payment gateway industry, numerous suppliers are providing comparable services. This can make it difficult for new competitors to gain traction in the market.

Market Opportunities

Providers of payment gateways can grow into new regional markets and serve the distinct payment preferences of customers in those areas. Payment gateway providers can incorporate these technologies to offer their consumers a more seamless and convenient payment experience thanks to the rising popularity of mobile payments, digital wallets, and other developing technologies.

In order to develop new value propositions and improve the overall customer experience, payment gateway providers can interact with other participants in the payments ecosystem, such as banks, card networks, and merchants. Owing to the increase in cybercrime and fraud, payment gateway providers can set themselves apart from the competition by providing their clients with increased security features and fraud protection techniques.

Grow your profit margin with Market.us – Purchase This Premium Report at https://market.us/purchase-report/?report_id=32318

Report Segmentation of the payment gateway market

Type Insight

Based on type, the hosted segment dominates the market with 59% of the market share. Owing to the simple payment process and decreased merchant liability. The demand for hosted payment gateway is rising with retailers. Hosted payment gateways have a more number of benefits including better security and reduce merchant liability. The Provider’s website is where the payment information was entered a timeless chance of fraud and data leakage because the merchant does not have access to the customer’s personal payment information. The non-hosted segment is expected the significant growth over the period. All over the world, many merchants prefer a non-hosted payment gateway for their websites because they can maintain control of the entire checkout process, including the design and layout process. While providing an effortless shopping experience for consumers with APIs, the retailer can permit customers to finish the transaction by directly entering their debit or credit card information on their checkout page.

Enterprise Size Insight

By enterprise size, the larger enterprise segment dominates the market with a 55% market share. Owing to the larger website traffic larger businesses them checkout solutions for their client. Supporting several digital payment methods such as net banking, and credit and debit card payment getaways system may guarantee a simple checkout process for their clients. These businesses need a very safe and secure method of transaction which was made possible by payment gateways. The small and medium enterprises segment is anticipated the highest growth over the forecasting period. Small and medium enterprises are using payment gateways more quickly and providing customers with more convenience. Some small and medium enterprises are restructuring their revenue plan and operation by taking a more digital strategy.

End User Insight

Based on end-user, the retail and e-commerce segment dominates the payment gateway market with a 28% market share. For online shops and e-commerce companies to receive customer payments, payment gateways are crucial. They make it possible for companies to accept payments made with credit as well as debit cards as well as other electronic payment methods like bank transfers and mobile wallets. Traditional brick-and-mortar retailers also use payment gateways to take card payments at the point of sale. Usually, a physical card terminal also a mobile device with a card reader attached is used for this. The BFSI segment is expected to witness significant growth during the forecasting period, with the rise of electronic payments and e-commerce, the BFSI (Banking, Financial Services, and Insurance) sector’s payment gateway market is a quickly expanding business. Customers can use credit/debit cards, net banking, and mobile wallets to pay for goods and services on a secure platform provided by payment gateway providers.

Recent Development of the Payment Gateway Market

- In November 2022- The premier e-commerce agency, object source, and Blue Snap, the payment orchestration platform for major B2B and B2C enterprises, have expanded their collaboration to help online retailers across Europe and improve Magneto integration for the developing EU Market.

- In August 2022- The Central Bank of India granted an in-principle Payment Aggregator (PA) license to the financial services platform Mswipe Technologies (RBI). Mswipe will be able to create its internal online payment mechanism with this approval.

For more insights on the historical and Forecast market data from 2016 to 2032 – download a sample report at https://market.us/report/payment-gateways-market/request-sample/

Market Segmentation

Based on Type

Based on the Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

Based on the End User

- Retail & E-commerce

- BFSI

- Media & Entertainment

- Travel & Hospitality

- Healthcare

- Energy & Utilities

- IT & Telecom

- Other End User

By Geography

-

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

-

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

-

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

-

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

The market for payment gateways is a sector that is expanding quickly, with the increased acceptance of online shopping as well as an increase in digital transactions. Such as several major firms are vying for market share, making the industry extremely competitive. PayPal Holdings, Inc., Stripe Inc., Amazon Payments Inc., Authorize.net, and Square, Inc. are a few of the market’s top competitors. These businesses provide several varieties of payment processing services, such as processing credit and debit cards, integrating digital wallets as well detecting and preventing fraud.

Some of the major players include:

- Adyen

- Amazon Payments Inc

- Authorize Net

- Bitpay Inc

- Braintree

- PayPal Holdings Inc

- PayU Group

- Stripe

- Verifone Holdings Inc

- Wepay Inc

- Stripe Inc

- Other Key Players

Browse More Related Reports:

- Payment Processing Solutions Market size is expected to be worth around USD 198 billion by 2032 from USD 65.6 billion in 2022, growing at a CAGR of 12.00% during the forecast period from 2023 to 2032.

- Commercial Payment Cards Market size is expected to be worth around USD 33.69 billion by 2032 from USD 15.750 million in 2022, growing at a CAGR of 7.9% during the forecast period 2023 to 2032.

- Contactless Payments Market was valued at USD 22.4 billion in 2022 and is expected to grow to USD 90.6 billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 15.4%.

- Interactive KIOSK Market size was valued at USD 28.8 billion in 2022. Between 2023 and 2032, this market is estimated to register a growth rate of CAGR of 6.3% and a market value of USD 52.3 billion.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog:

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest LifeStyle News Click Here

For the latest news and updates, follow us on Google News.