Rate expectations: developing economies threatened by US inflation

As policymakers across the developing world battle the persistent spread of coronavirus, they also face the economic threat of inflation — and not just at home.

Escalating price growth in major economies, in particular the US, is fuelling investors’ expectations of rate rises. That pushes up bond yields, making it more expensive for other countries to sell debt as buyers demand higher returns.

What should be good news — the beginning of a global recovery — has instead become a threat: that the cost of borrowing will hit dangerously high levels in countries such as South Africa and Brazil, throwing their already precarious public finances into disarray.

Inflation: A New Era?

Prices are rising in many major economies. The FT examines whether inflation is back for good.

DAY 1: Advanced economies have not faced rapidly rising inflation for decades. Is that about to change?

DAY 2: The global consensus among central bankers on how best to foster low and stable inflation has broken down.

DAY 3: The canary in the coal mine for US inflation: used cars.

DAY 4: How the virus disrupted official inflation statistics.

DAY 5: Why rising prices in advanced economies are a problem for indebted developing countries.

“Emerging economies should be worrying more about US inflation than about their own,” said Tatiana Lysenko, lead economist for emerging markets at S&P Global Ratings.

It is not just that inflation and rising yields in the US push up borrowing costs in the developing world, she said. The broader risk is that the US economy will power ahead of emerging economies, causing outflows from their stocks and bonds and, eventually, currency weakness.

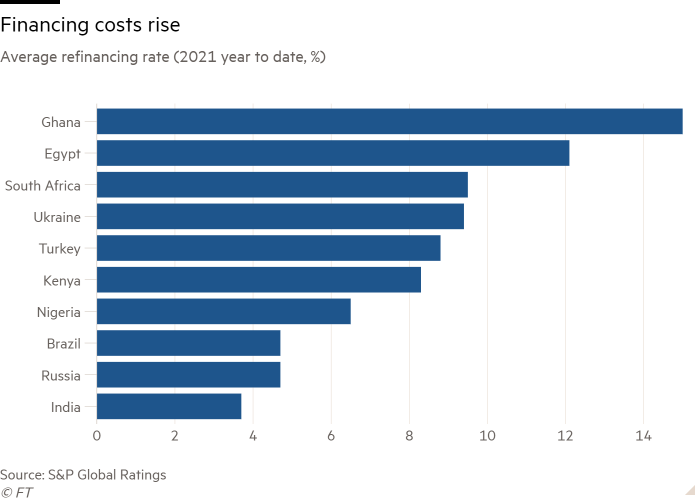

While rich countries have been able to borrow during the pandemic at very low rates, many developing countries already face a much higher cost of finance.

Data from S&P show that refinancing costs for 15 of the 18 largest developed economies have fallen below their average cost of borrowing by more than a percentage point. Most are paying a fraction of 1 per cent. A 1 percentage point rise in financing costs would be easy for most to bear.

The same cannot be said of developing countries. Egypt, which must refinance debt equal to 38 per cent of gross domestic product this year, is paying an average rate of 12.1 per cent, above its average cost of 11.8 per cent, according to S&P. Ghana is paying 15 per cent, compared with an average of 11.5 per cent.

The danger lies not only in very high rates. Brazil has refinanced at an average rate of 4.7 per cent this year, lower than the average cost of its existing debt. But it did so by selling bonds that must be repaid more quickly than in the past.

This unpicks the work of years in which Brazil sold longer-dated and fixed rate debt to make its finances more sustainable. Last year the average maturity of its new debt was two years, down from five in 2019.

Brazil needs to refinance debt equal to 13 per cent of GDP this year — a lower proportion than smaller nations, but a greater sum in total, and it could be scuppered by rising rates or a slower-than-expected recovery.

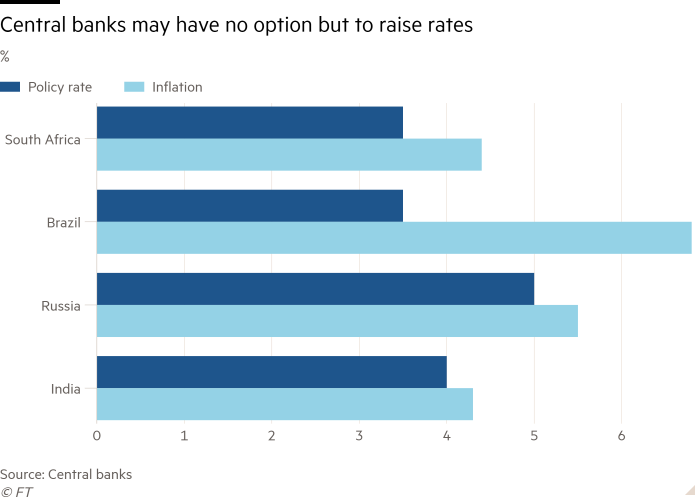

Its central bank has already raised rates twice this year in an effort to quell price pressures after inflation overshot its target range of 2.25 to 5.25 per cent. Another rise is likely at its next meeting later this month, and it forecasts a base rate of 5.5 per cent by year-end, up from a record low of 2 per cent in March.

Brazil is a clear example of how inflation and rising yields are a threat to debt sustainability, said William Jackson of Capital Economics. “It has stretched public finances, rising inflation and a central bank that is raising rates, feeding into debt service costs.”

South Africa is in the same category, he said, along with Egypt and others with large refinancing needs.

There are mitigating factors. For example Brazil, South Africa and India all rely much more on domestic lenders than on foreign ones. That makes them less vulnerable to capital outflows than they were during the debt crises of the late 20th century.

India in particular has turned to its domestic banking system to issue benchmark 10-year bonds at rates capped at about 6 per cent. It too has borrowed at shorter maturities during the pandemic, although its low refinancing requirement this year — equal to just 3.3 per cent of GDP — makes it less vulnerable to rising rates.

But William Foster, vice-president in the sovereign risk group at Moody’s Investors Service, said that India’s fiscal problems leave it dependent on debt rather than government revenues to finance its pandemic response.

“India runs large fiscal deficits and has a very high debt stock,” he said. “The most important thing for debt sustainability is to achieve a higher rate of medium term growth, through reforms and other measures to crowd in the private investment that we haven’t seen for years.”

If, as many policymakers hope, this year’s rise in inflation turns out to be transitory, emerging economies’ interest rates may not have to rise far.

Roberto Campos Neto, governor of Brazil’s central bank, told a conference this week that the issue was whether inflation was temporary and justified by growth, or whether central banks should raise rates further. “The first case is benign for the emerging world,” he said. “The second is not.”

Food and commodity prices are already growing at a pace that is fuelling consumers’ inflation expectations, Lysenko said. If interest rates go up significantly, reducing developing economies’ debt to sustainable levels — and delivering growth — will become much harder.

“In an interconnected world with a lot of capital flows, US yields have significant spillovers,” she said. “It is too early [for emerging markets] to tighten [monetary policy], as to do so now could undermine their recovery. But some countries may not have much space left not to tighten.”

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Education News Click Here

For the latest news and updates, follow us on Google News.