US shale dealmaking wave is transforming the industry

Shale Oil & Gas updates

Sign up to myFT Daily Digest to be the first to know about Shale Oil & Gas news.

A wave of dealmaking in America’s shale patch is intensifying, wiping out weak players and leaving the once-fractured sector in the hands of a new breed of “super independents”.

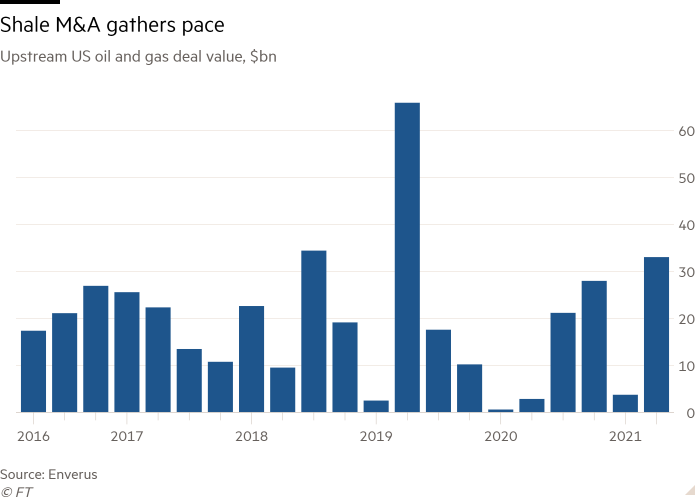

More than $30bn in oil and gas deals were done in the second quarter and analysts and bankers expect the run of dealmaking to continue. Investors are pushing shale producers to bulk up in the hopes that larger players will rein in rampant supply growth, deliver better returns and clean up the industry’s operations amid mounting environmental pressures.

“We have way too many players in the sector that are way too undercapitalised and too small to drive the efficiencies and returns that investors need, so we will continue to see consolidation happen,” said Stephen Trauber, a vice-chair and veteran energy banker at Citi.

“If you’re below a $10bn market cap, it is going to be hard for you to sustain yourself long term,” he added.

Only a handful of shale specialists are in that $10bn club today, including larger producers ConocoPhillips, EOG Resources and Pioneer Natural Resources. Below them is a still deeply fractured corporate landscape with dozens of smaller private and publicly held producers that have carved up the country’s largest oilfields, resulting, analysts say, in chronic oversupply and high costs.

The $33bn in deals in the second quarter was the highest quarterly total since the second quarter of 2019, when Occidental Petroleum bought Anadarko for $55bn, according to data from Enverus, an industry consultancy. There has been more than $85bn in deals over the past 12 months as the sector has emerged from a pandemic-driven crash that decimated its finances.

Andrew Dittmar, lead M&A analyst at Enverus, said all the “driving factors” behind the recent wave of deals were still in place and that shale producers had “prioritised consolidation” as the sector looked to draw investors back to the sector.

He added that public companies had recently turned their attention to buying private equity-backed producers. In April, Pioneer Natural Resources bought DoublePoint Energy, backed by Houston-based energy investment firm Quantum Energy Partners, for $6.4bn in the biggest such deal.

Scott Sheffield, Pioneer’s chief executive, said at the time that the deal, which made his company the largest producer in the prolific Permian oilfield in Texas, would deliver “significant benefits of scale” while the company planned to tame DoublePoint’s rapid growth.

Private equity groups pumped tens of billions of dollars into the shale sector during its boom years in the early and mid-2010s. But many have found it difficult to exit their positions, especially as public markets soured on the industry, which has generated hefty losses for shareholders.

“Pulling off an IPO is exceptionally hard, we’ve seen one in the last five years,” said Dittmar of Enverus. “Even they struggled out of the gate so there’s not a lot of welcome in equity markets for new companies.”

The recent rise in US crude prices to about $70 a barrel is a potentially attractive exit point for private companies, analysts say. This is especially so as many of those energy-focused private equity shops are shifting their focus to low-carbon technologies, where markets are booming in what many see as an echo of the shale frenzy a few years ago.

“Private equity is doing one of two things,” said Trauber of Citi. “Either merging among themselves to get bigger to ultimately sell to a big public company, or selling directly to a public company, if they have the quality and size now.”

Increasing regulatory and investor demands for oil and gas producers to slash their emissions is also expected to fuel the industry’s consolidation as larger companies have more financial capacity to invest in pollution mitigation. A Dallas Federal Reserve survey late last year found that just 10 per cent of smaller companies had a plan to cut their carbon emissions, while 50 per cent of their bigger rivals did.

While green pressures push some shale companies to merge, analysts say the US supermajors ExxonMobil and Chevron are expected to remain on the sidelines for now.

Both companies lost major climate-focused shareholder votes earlier this year and are under pressure to step up investments in low-carbon technologies. Doing a major shale deal now would send the “wrong signal”, said one energy banker.

Still, there are plenty of large independents that want to set themselves up for the long haul, which means getting bigger. “We’re headed towards a more consolidated industry,” said Dittmar. “It’s just a matter of the pacing that we get there.”

Twice weekly newsletter

Energy is the world’s indispensable business and Energy Source is its newsletter. Every Tuesday and Thursday, direct to your inbox, Energy Source brings you essential news, forward-thinking analysis and insider intelligence. Sign up here.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Education News Click Here

For the latest news and updates, follow us on Google News.