US stocks head for longest monthly winning streak in two years

Receive free Markets updates

We’ll send you a myFT Daily Digest email rounding up the latest Markets news every morning.

US stocks are on track to record their longest monthly winning streak in two years, as optimism about falling inflation and resilient growth encourages increasingly broad market gains.

The S&P 500 has risen about 3 per cent in July, despite trading flat during lunchtime on Monday. Absent a big reversal in the final hours of trading, that would mark the fifth consecutive month of gains and the longest such run since the summer of 2021.

The tech-dominated Nasdaq Composite was up 0.1 per cent on Monday afternoon, but has gained almost 4 per cent since the end of June.

“The market rally has really reminded people why it’s just so hard to walk away from equities,” said Alex Chaloff, chief investment officer at Bernstein Private Wealth. “This has been one of the weirdest rallies we’ve ever had . . . [but] equities are still ripping higher.”

For the first five months of 2023, the increase in benchmark indices was driven entirely by the so-called magnificent seven megacap groups — Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

However, “the opportunity going forward is in the forgotten 493”, Chaloff predicted, referring to the remaining stocks in the S&P 500.

Stock price gains have begun to broaden over the past two months amid signs the Federal Reserve is nearing the end of its cycle of rate increases, and may succeed in bringing down inflation without causing a recession.

A version of the S&P 500 in which the components are equally weighted within the index has risen 11 per cent since the start of June, compared with a 1 per cent decline in the preceding five months.

The Fed last week raised the federal funds rate to a 22-year high and left the door open to further increases, but many economists expect the most recent move will be the last increase in the current cycle.

Optimism about the likelihood of a “soft landing” has also been reflected in debt markets, with the premium that risky corporate borrowers have to pay to issue new debt shrinking rapidly. The gap between yields on US junk bonds and equivalent Treasury notes has tightened by almost 0.9 percentage points since the start of June, one of the biggest two-month drops since 2020.

Yields on longer-dated Treasuries climbed in July, although those on their shorter-dated counterparts have been about flat.

European stocks also enjoyed a decent month, with the continent-wide Stoxx 600 adding 1.9 per cent for its second consecutive monthly gain. That included a 0.2 per cent increase on Monday following better than expected economic growth data.

France’s Cac 40 rose 0.3 per cent on Monday and Germany’s Dax traded flat, having touched a record high earlier in the session.

Figures showed the eurozone economy grew a higher than expected 0.3 per cent in the three months to July after stagnating in the previous quarter. Separate figures showed that annual inflation in the 20-country currency bloc slowed to 5.3 per cent in July.

European Central Bank president Christine Lagarde last week suggested it may also be at the end of its rate-rising cycle after lifting interest rates in the currency bloc to 3.75 per cent, their highest level since 2001.

Meanwhile, investors prepared for more big US tech companies, including Apple and Amazon, to report earnings this week, offering more insight into the health of Wall Street’s high-flying tech sector.

“This week’s Apple earnings report [on Thursday] is critical for markets,” said Michael Landsberg, chief investment officer at Landsberg Bennett Private Wealth Management.

“Apple is not only the market’s most valuable company, it’s also a litmus test for consumer spending, which so far has been keeping the economy afloat,” he noted.

Upbeat results from heavyweight growth companies, including Meta and Alphabet, have so far bolstered investor sentiment this earnings season.

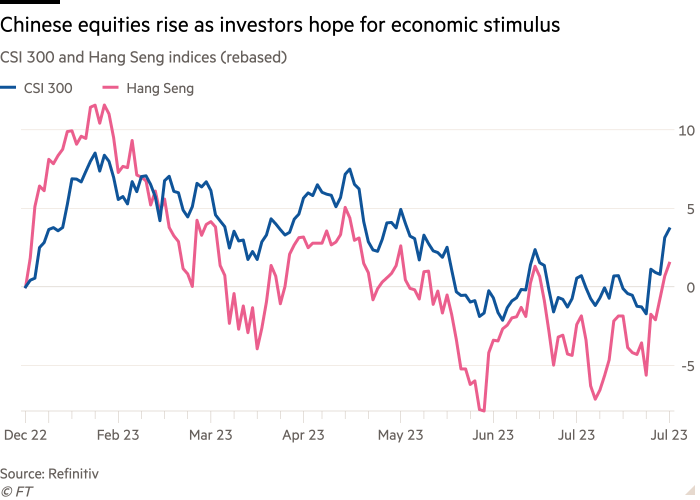

Asian equities rallied as investors bet on more economic stimulus from China’s government, after data showed activity in the country’s services sector expanded less than forecast in July, and the manufacturing remained in contractionary territory.

Hong Kong’s Hang Seng index gained 0.8 per cent, while the benchmark CSI 300 rose 0.6 per cent, as both reached their highest levels since early May.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Education News Click Here

For the latest news and updates, follow us on Google News.