Wall Street banks set to report record profits for 2021

Wall Street’s biggest banks this month are set to report record profits for 2021 thanks to bumper investment banking fees and lower-than-expected losses on loans during the pandemic, with analysts cautioning it may take years to repeat such stellar earnings.

Citigroup and JPMorgan Chase are the first big banks to post fourth-quarter results, reporting on January 14. They are followed by Goldman Sachs on January 18, and then Morgan Stanley and Bank of America on January 19.

Of those, analysts forecast all but Citi will report their highest-ever full-year profits, according to estimates compiled by Bloomberg and historical earnings data from S&P Capital IQ.

“You might have to go all the way out to 2024 before earnings are higher than they were in 2021,” said Matt O’Connor, head of large-cap bank research at Deutsche Bank.

Nevertheless, the prospect of interest rate rises by the Federal Reserve in 2022 is feeding optimism that banks could be set for another strong year.

“We expect bank stocks to continue to outperform the market in 2022,” Jason Goldberg, an analyst at Barclays, wrote in a note to clients this week.

Earnings in 2021 were flattered by releases of reserves banks had set aside to cover potential losses from loans which they feared could turn sour due to the pandemic.

Losses have so far proved far less prevalent than feared. Goldman analysts estimate the seven big banks it covers, which include JPMorgan and Bank of America, have now released $36bn of the $50bn they had initially allocated in anticipation of loan losses.

Banks have also benefited from blockbuster investment banking fees, with global mergers and acquisitions in 2021 hitting their highest levels since records.

“People don’t believe that, particularly the fee-based capital markets businesses, these types of levels experienced in 2021 are necessarily normal,” said Devin Ryan, an analyst with JMP Securities.

Banks so far have been using profits to invest in technology, pay bonuses and buy back their own stock.

After such a big year, investors are questioning whether 2021 represented “peak earnings” for big banks, according to Richard Ramsden, banking analyst with Goldman Sachs.

“What investors are trying to figure out is, has the market overpriced or underpriced the rate optionality that’s been embedded into bank stocks?” Ramsden said.

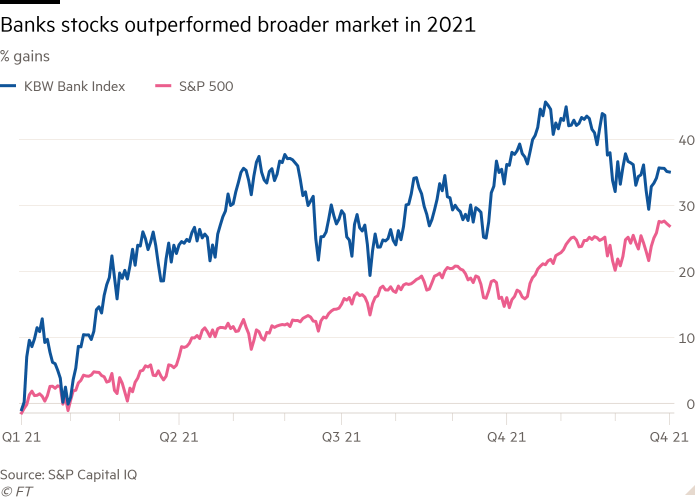

Right now the market is pricing in another good year for banks. US bank stocks rose 35 per cent in 2021, according to Deutsche Bank analysts, outperforming the S&P 500, and have surged again in the first few days of 2022.

Investors are betting rising interest rates will resuscitate earnings banks make from loans. Loan demand, which was sluggish in 2021 amid record amounts of government stimulus, has also shown signs of improving, recent Fed data showed.

Analysts predict a greater proportion of earnings from loans instead of the release of loan loss reserves would garner a better valuation for bank stocks from the market, even if total earnings come in lower for the year.

“It is a fair point that 2022 is kind of a transition year where underlying earnings are probably getting better but reported earnings are going down,” O’Connor said.

More demand for loans in a higher rate environment would also enable banks to get more out of the large base of deposits which swelled during the pandemic. At JPMorgan, the largest US bank by assets, deposits rose more than 50 per cent from the end of 2019 to September 2021 to $2.4tn.

“When rates start going up, said Keith Horowitz, US banks analyst at Citigroup, “that’s when you really start to see the real benefit of these deposits.”

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Education News Click Here

For the latest news and updates, follow us on Google News.